Fed Taper: Too soon or its time? and More

- Abhimanyu Gupta

- Oct 2, 2021

- 3 min read

Updated: Oct 14, 2021

There has been a share buyback spree in the US big tech and big financials. The top 10 companies – ranked by their cumulative buybacks over the past five years – bought back more of their shares than ever in Q2: $85 billion, according to S&P Dow Jones Indices this week, accounting for 43% of the total share buybacks by all S&P 500 companies. Since 2014, these 10 companies have bought back $1.13 trillion of their own shares. The intention is to reduce dilution and enhance the EPS numbers, but this doesn’t seem to have been working as expected, as the number of companies who have really been able to achieve this is lowering every year, while those piling up debt to buyback shares is expanding large.

China banned bitcoin mining to draw back on the energy consumption in the mining process, given the recent energy vacuum. This energy cut down is now affecting the industries, and that isn't good news for an economy which boasts its production and export driven growth. And these recent energy crises can trigger another layer of supply chain disruptions only when the inventory starts building up.

Fed officials now are drawing the timeline to not only reduce the pace of asset purchase but also start cutting back on the assets on its BS. After which they plan to start the taper. The last time the Fed went all bunkers bust on the market to unwind its assets, repo and money markets were shaken to misery. But this time they have set up the SRF facility to take care of any market dislocations.

One of the most strange economic findings from the recovery this time is the indifference towards higher prices. Consumers and businesses are immune to any price spike and have inflated asset prices to unjustified levels. But can the Fed correct this revert back to pre pandemic exuberance. Or are we entering an altogether new regime and stance?

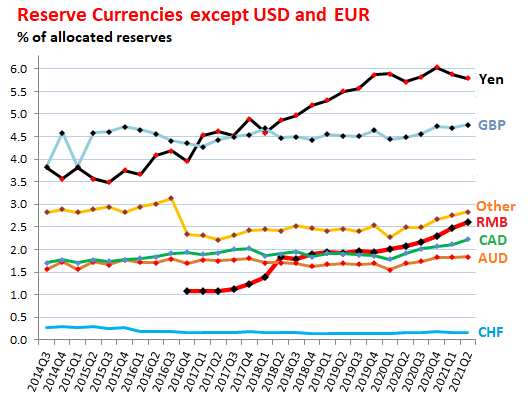

Share of the dollar denominated reserves as a part of the total foreign reserves has been reducing from 2014, and now central banks and governments are reluctant to add dollar securities. We can see the rise in RMB as a reserve currency. It has done exceedingly well, even after the fact that it is not freely convertible.

We have been hearing that the Fed interest rate repression and currency flush is leading to inflationary pressures, but do we understand why is that so? It's primarily because the policies have led to massive rise in the wealth of primarily the wealthy and thus their spendthrift nature is causing an artificial inflation, where jobs are created but the prices are skyrocketing.

Global investors have added more US stocks than any other international developed market. This comes at the backdrop of best performing DM in the world in 2021, with a clear 5% outperformance against its European counterpart. This Is despite the fact of elevated levels of US indices, taper fears and inflation deadlock.

The stagflation fears are reemerging in Ems, especially because they aren't able to raise rates until the Fed starts, which then leads to record high inflation. With fading growth projections and supply chain bottlenecks increased by the energy crisis, the central banks will have to innovate to keep us away from stagflation

Growing numbers of buy side asset allocators are planning to reduce their Chinese exposure. This can lead to massive foreign outflows in China, and thus will surely have an impact on RMB. This is despite the investments and business friendly policies enacted in 2019 to own 100% stake in a Chinese entity.

Interesting Charts:

Comments